All Categories

Featured

Table of Contents

The definition of a certified investor (if any type of), and the repercussions of being categorized as such, vary between countries.

It specifies advanced capitalists so that they can be dealt with as wholesale (instead than retail) customers., an individual with a sophisticated financier certificate is a sophisticated investor for the purpose of Phase 6D, and a wholesale customer for the function of Phase 7.

A corporation incorporated abroad whose activities resemble those of the companies laid out above (accredited investor application). s 5 of the Securities Act (1978) defines an innovative financier in New Zealand for the objectives of subsection (2CC)(a), a person is well-off if an independent chartered accountant accredits, no even more than twelve month prior to the deal is made, that the legal accountant is satisfied on reasonable grounds that the person (a) has net properties of at least $2,000,000; or (b) had an annual gross earnings of a minimum of $200,000 for each and every of the last two economic years

"Spousal equivalent" to the recognized financier meaning, so that spousal matchings might pool their finances for the purpose of qualifying as recognized investors. Fetched 2015-02-28."The New CVM Guidelines (Nos.

Sec Accredited Investor Verification

17 C.F.R. sec. BAM Capital."More Capitalists May Get Access to Private Markets.

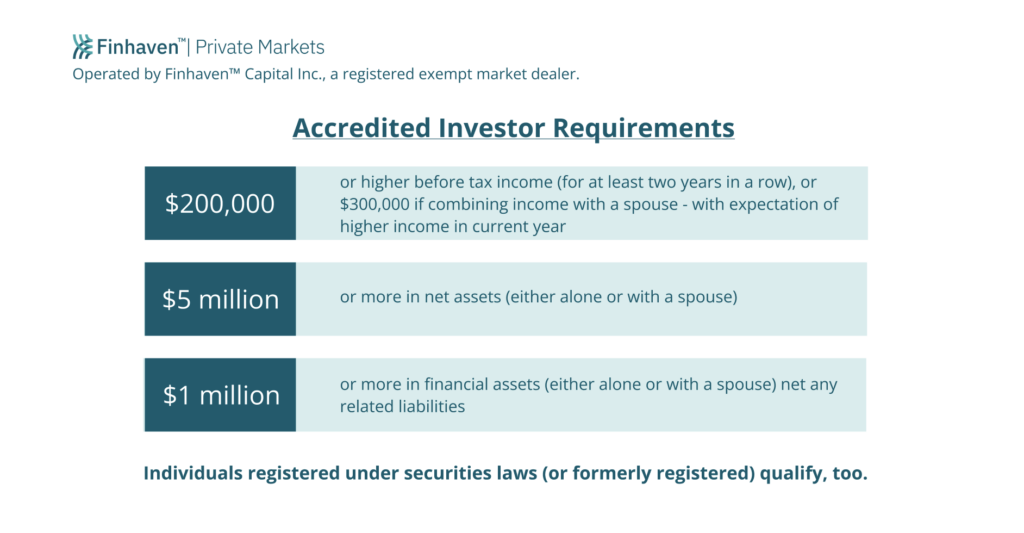

Certified investors consist of high-net-worth individuals, financial institutions, insurance coverage companies, brokers, and counts on. Accredited financiers are specified by the SEC as qualified to purchase complex or innovative sorts of protections that are not very closely regulated - accredited investor requirement. Specific requirements need to be met, such as having an average annual revenue over $200,000 ($300,000 with a spouse or residential companion) or operating in the economic market

Unregistered safety and securities are inherently riskier due to the fact that they do not have the regular disclosure requirements that feature SEC enrollment. Investopedia/ Katie Kerpel Accredited financiers have blessed access to pre-IPO companies, venture capital firms, hedge funds, angel investments, and different offers entailing complex and higher-risk investments and instruments. A business that is looking for to increase a round of financing might choose to directly come close to accredited investors.

It is not a public company however wishes to release a first public offering (IPO) in the future. Such a business may choose to offer safety and securities to certified financiers straight. This type of share offering is described as a personal placement. accredited and non accredited investors. For accredited capitalists, there is a high possibility for risk or incentive.

Investor Net Worth

The regulations for recognized capitalists vary among territories. In the U.S, the interpretation of an accredited investor is placed forth by the SEC in Guideline 501 of Regulation D. To be a recognized financier, a person needs to have a yearly earnings exceeding $200,000 ($300,000 for joint revenue) for the last two years with the expectation of earning the very same or a higher earnings in the existing year.

An accredited investor must have a net worth going beyond $1 million, either independently or collectively with a spouse. This quantity can not include a primary house. The SEC additionally considers candidates to be accredited financiers if they are basic partners, executive officers, or directors of a firm that is issuing non listed securities.

Accredited Investor Series 7

If an entity is composed of equity proprietors that are certified investors, the entity itself is a recognized investor. Nonetheless, an organization can not be created with the sole objective of acquiring details protections. An individual can qualify as a certified investor by demonstrating sufficient education or job experience in the financial industry.

Individuals that intend to be approved investors do not relate to the SEC for the classification. qualified purchaser definition. Instead, it is the duty of the business using a personal positioning to make certain that all of those approached are accredited investors. People or parties who intend to be approved investors can come close to the issuer of the non listed safeties

Lists Of Accredited Investors

As an example, expect there is an individual whose income was $150,000 for the last 3 years. They reported a primary home value of $1 million (with a mortgage of $200,000), an auto worth $100,000 (with a superior funding of $50,000), a 401(k) account with $500,000, and a savings account with $450,000.

Net well worth is computed as possessions minus liabilities. This person's net worth is precisely $1 million. This involves a computation of their assets (other than their main residence) of $1,050,000 ($100,000 + $500,000 + $450,000) less an auto loan amounting to $50,000. Given that they meet the net worth requirement, they qualify to be an accredited financier.

There are a couple of much less typical certifications, such as managing a trust with even more than $5 million in properties. Under government safeties regulations, only those that are recognized financiers may get involved in certain safeties offerings. These might include shares in private positionings, structured products, and private equity or hedge funds, among others.

Latest Posts

List Of Properties With Delinquent Taxes

What Is A Delinquent Tax Sale

How Do Tax Foreclosure Sales Work