All Categories

Featured

Table of Contents

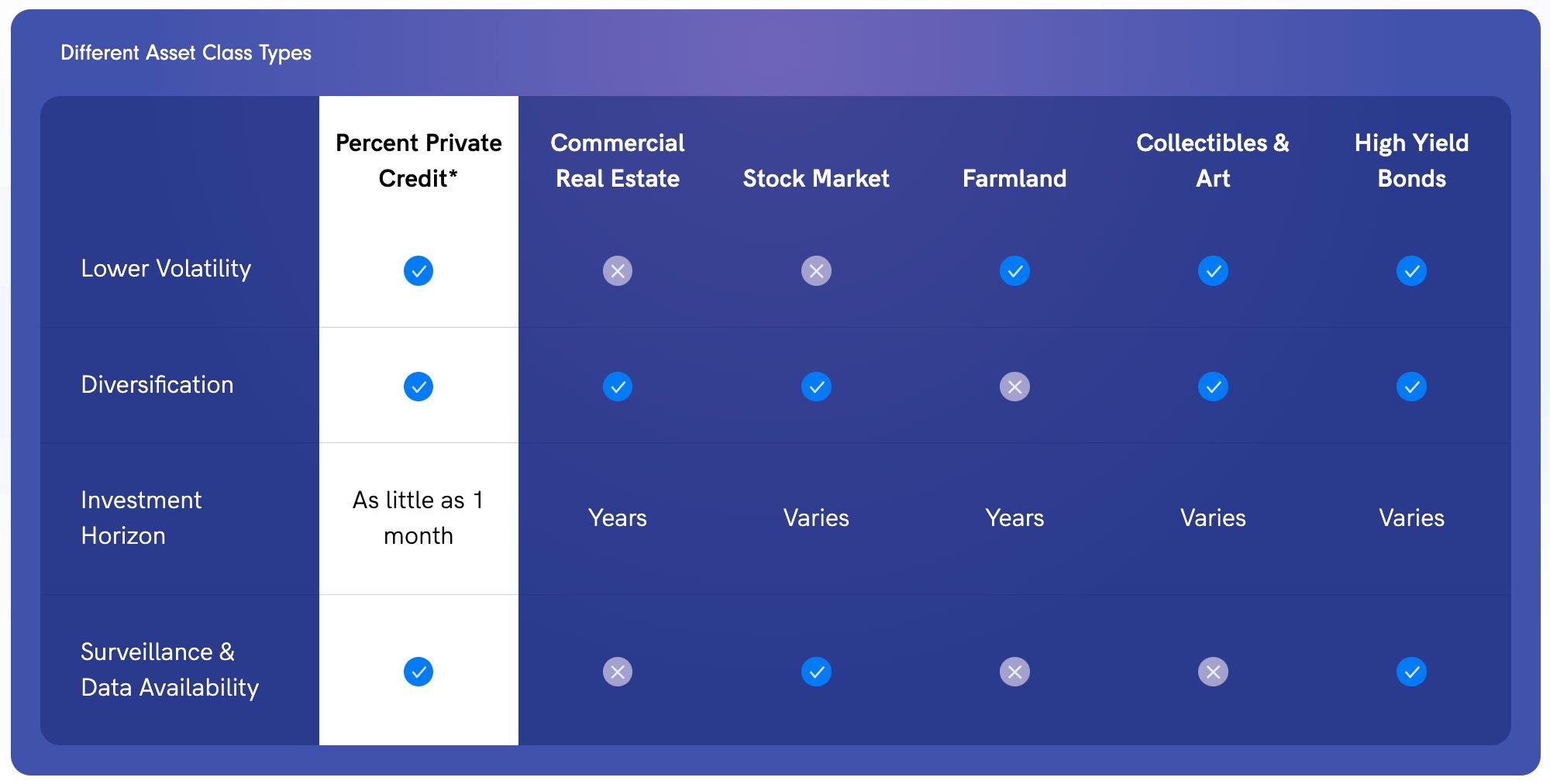

Picking to spend in the realty market, supplies, or various other conventional sorts of possessions is prudent. When choosing whether you need to invest in accredited capitalist chances, you should stabilize the trade-off you make in between higher-reward prospective with the lack of reporting requirements or regulatory openness. It needs to be claimed that personal placements involve higher degrees of danger and can on a regular basis represent illiquid financial investments.

Especially, absolutely nothing below should be translated to state or imply that previous results are a sign of future efficiency neither ought to it be interpreted that FINRA, the SEC or any kind of other safeties regulator approves of any one of these safeties. Additionally, when examining personal placements from sponsors or business supplying them to certified investors, they can offer no warranties shared or implied as to accuracy, completeness, or results gotten from any kind of information given in their discussions or discussions.

The business ought to supply information to you with a record called the Private Placement Memorandum (PPM) that offers a much more thorough description of costs and risks associated with getting involved in the investment. Interests in these offers are only supplied to individuals that certify as Accredited Investors under the Securities Act, and a as specified in Area 2(a)( 51 )(A) under the Firm Act or a qualified staff member of the monitoring business.

There will certainly not be any public market for the Passions.

Back in the 1990s and early 2000s, hedge funds were known for their market-beating performances. Generally, the supervisor of an investment fund will set aside a part of their readily available possessions for a hedged bet.

How do I apply for Real Estate Development Opportunities For Accredited Investors?

A fund manager for an intermittent sector might devote a portion of the assets to supplies in a non-cyclical industry to balance out the losses in instance the economic climate storage tanks. Some hedge fund supervisors make use of riskier strategies like utilizing obtained money to buy more of an asset simply to multiply their potential returns.

Similar to mutual funds, hedge funds are professionally managed by job investors. Unlike shared funds, hedge funds are not as purely controlled by the SEC. This is why they undergo less scrutiny. Hedge funds can put on different investments like shorts, alternatives, and by-products. They can likewise make different investments.

Where can I find affordable Real Estate Development Opportunities For Accredited Investors opportunities?

You may choose one whose investment approach straightens with your own. Do remember that these hedge fund cash managers do not come inexpensive. Hedge funds usually bill a cost of 1% to 2% of the possessions, along with 20% of the earnings which acts as a "performance fee".

High-yield financial investments bring in lots of financiers for their money flow. You can acquire a possession and get rewarded for keeping it. Recognized financiers have a lot more chances than retail financiers with high-yield financial investments and beyond. A greater selection offers accredited investors the opportunity to get higher returns than retail financiers. Certified investors are not your average investors.

Why is High-yield Real Estate Investments For Accredited Investors a good choice for accredited investors?

You need to fulfill a minimum of one of the adhering to specifications to become an accredited investor: You need to have over $1 million internet worth, excluding your primary house. Business entities count as accredited capitalists if they have over $5 million in properties under administration. You have to have a yearly earnings that exceeds $200,000/ yr ($300,000/ yr for partners filing together) You must be an authorized investment advisor or broker.

As an outcome, certified investors have more experience and money to spread throughout assets. Approved investors can go after a wider variety of assets, but more options do not assure higher returns. The majority of investors underperform the market, including certified investors. In spite of the higher status, recognized investors can make significant blunders and do not have access to expert details.

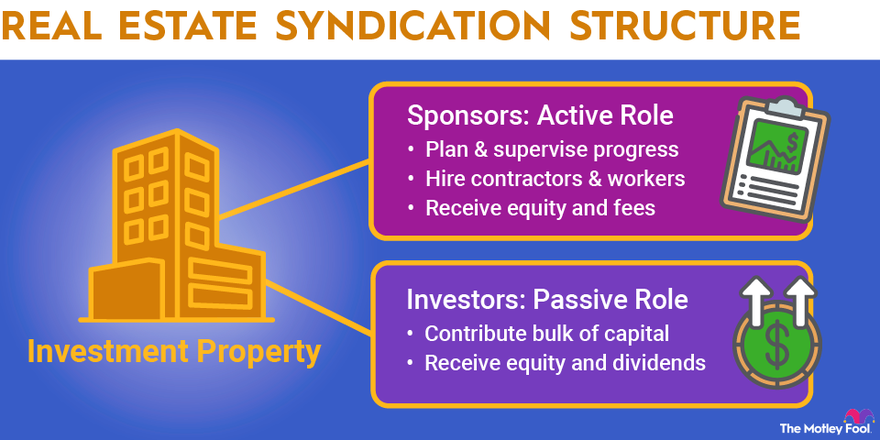

Crowdfunding offers certified investors a easy duty. Property investing can help replace your earnings or bring about a quicker retirement. On top of that, financiers can construct equity via positive capital and property appreciation. Genuine estate residential properties require substantial maintenance, and a lot can go wrong if you do not have the best group.

What happens if I don’t invest in Accredited Investor Property Investment Opportunities?

Genuine estate organizations pool cash from recognized investors to acquire homes straightened with recognized purposes. Accredited capitalists merge their cash with each other to fund purchases and residential property development.

Real estate financial investment depends on need to disperse 90% of their taxed earnings to shareholders as returns. REITs allow financiers to diversify quickly throughout numerous home classes with very little funding.

What is the best way to compare Private Real Estate Investments For Accredited Investors options?

The holder can choose to apply the exchangeable alternative or to offer prior to the conversion takes place. Convertible bonds permit financiers to buy bonds that can become stocks in the future. Financiers will certainly benefit if the stock cost increases considering that exchangeable financial investments offer them much more eye-catching entrance points. If the supply topples, financiers can choose against the conversion and protect their finances.

Latest Posts

List Of Properties With Delinquent Taxes

What Is A Delinquent Tax Sale

How Do Tax Foreclosure Sales Work